Determine the gain or loss on your hedging instrument and hedge item at the reporting date. Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been designated as a Designated Hedge Agreement so that such Credit Partys counterpartys credit.

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

The soft foliage and upright compact growth make Thujas common in residential gardens.

. The Dorothy Bohm v SSCLG 2017 EWHC 3217 Judgment clarifies that just because something is a positive contributor so long as it is. 3 a new accounting standard that. The accounting similar to a designated cash flow hedge.

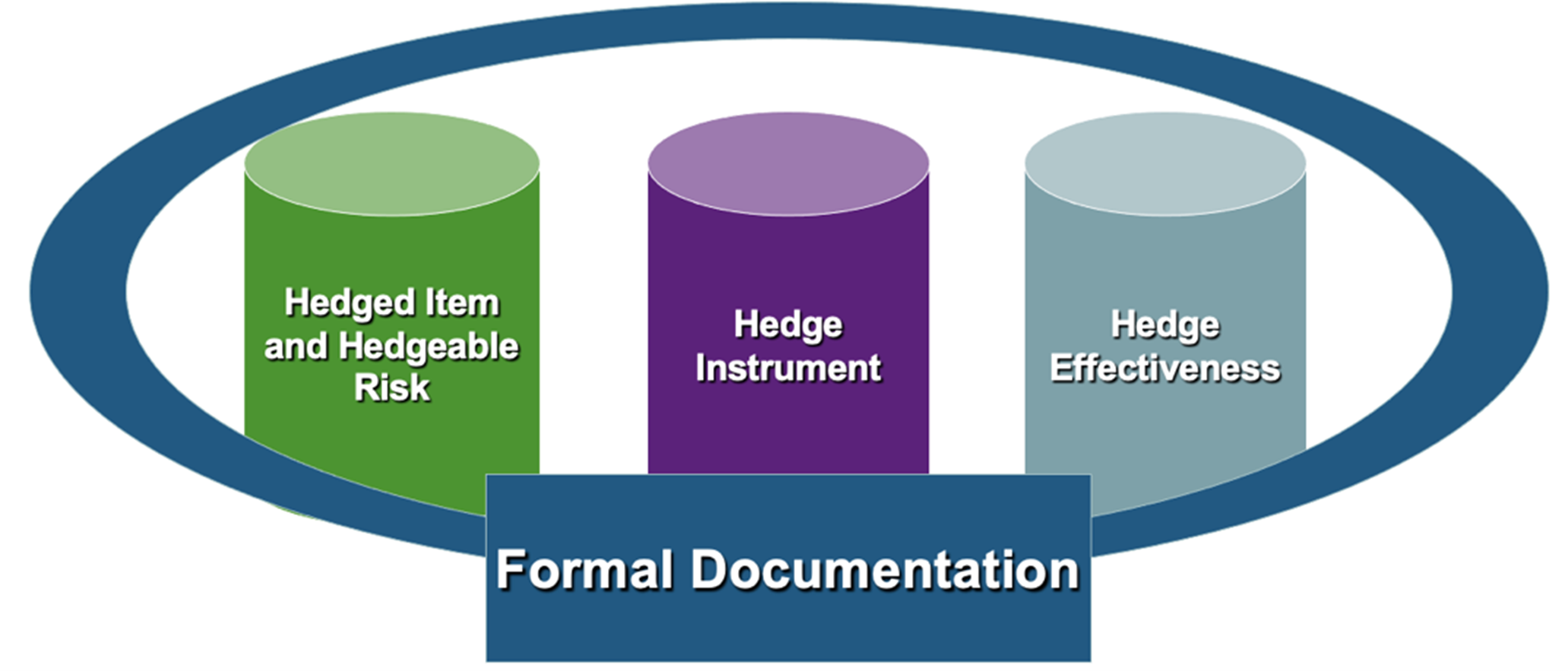

1 the substantial cost of documentation and ongoing monitoring of designated hedges. Non-derivative financial instruments measured at. Intrinsic value as hedging instrument.

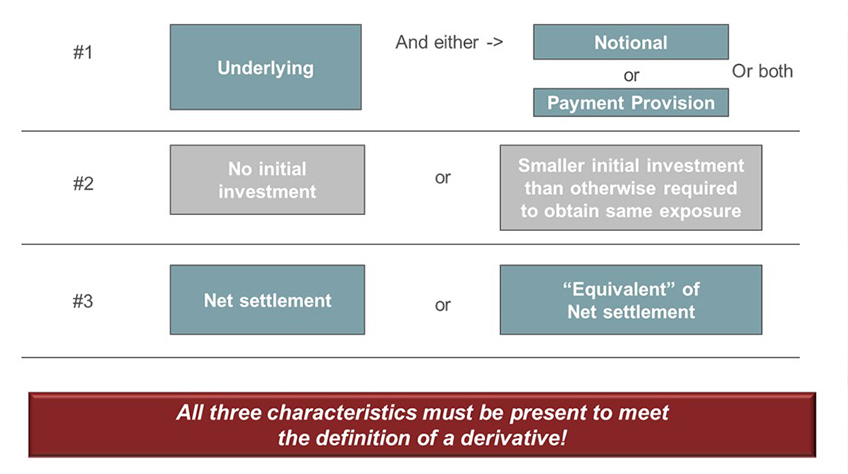

Under IFRS 9 risk components of financial items such as the SONIA rate replacement of LIBOR rate in a loan that bears interest at a floating rate of SONIA plus a spread could be designated as a hedged item provided they are separately identifiable and reliably measurable and risk components can be designated for non-financial hedged items provided. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the Administrative Agent has been designated as a Designated Hedge Agreement so that the. A non-derivative contract also can be used as a hedging instrument where the risk of hedging is relating to the foreign exchange risk in respect of a liability payable or receivable in foreign currency.

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Hedge accounting is an alternative to more traditional accounting methods for recording gains and losses. Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been designated as a Designated Hedge Agreement so that such Credit Partys counterpartys credit exposure.

IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options. Fair value hedge pertains to a fixed value item. In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges.

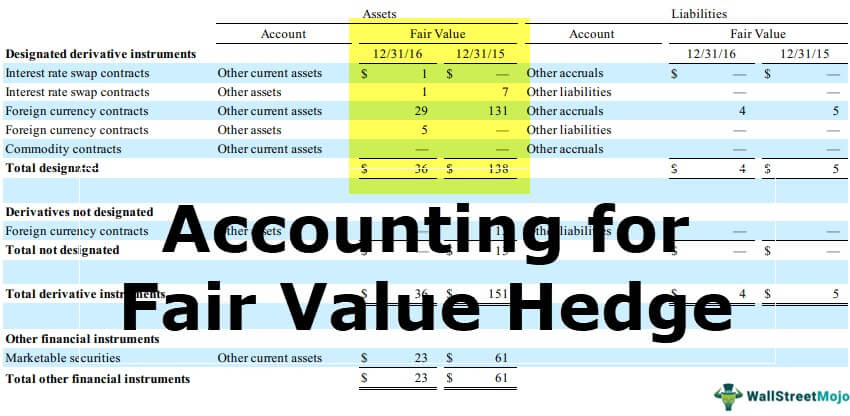

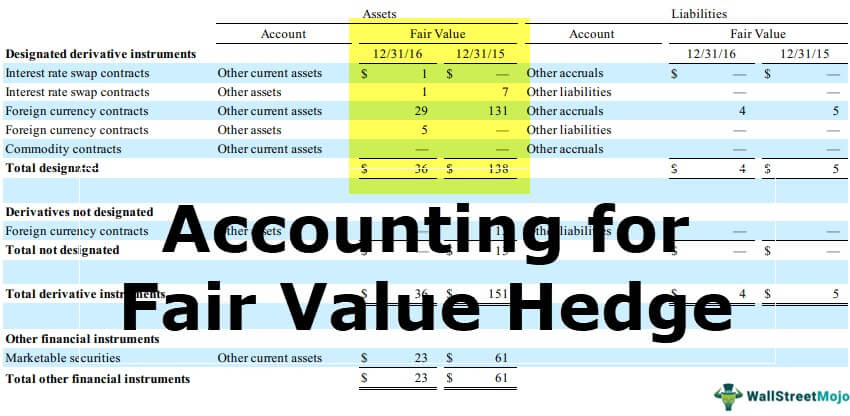

And ongoing monitoring of. Time value of an option is often the only composite of a premium paid and is considered by risk managers as a cost of hedging IFRS 9BC6387. A fair value hedge is a hedge of the exposure to changes in the fair value of an asset or liability or any such item that is attributable to a particular risk and can result in either profit or loss.

Hedging whether in your portfolio your business or anywhere else is about decreasing or transferring risk. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or. For example an entity can designate a liability in foreign currency as a hedging instrument to hedge a receivable in the same foreign currency.

However amounts are not subsequently recycled from. Common Holly Ilex aquifolium This plant is a popular security and privacy hedge. A recent Court Judgment has brought some additional and important clarification on how non-designated heritage assets NDHAs in Conservation Areas should be dealt with in the context of planning decisions.

Calculate the effective and ineffective portions of the gain or loss on the hedging instrument. Hedging is a valid strategy that can help protect your portfolio home. Recognition and Measurement is often criticised as being complex and rules-based thus ultimately not reflecting an entitys risk management activities.

If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. 12 The main changes in the IFRS 9 hedge accounting requirements Hedge accounting under IAS 39 Financial Instruments. A fair value hedge relates to a fixed value item.

Designated Fair value hedge. Accounting for Fair Value Hedges. For hedge accounting purposes only assets liabilities firm commitments or highly probable forecast transactions with a party external to the reporting entity can be designated as hedged items.

Designated net investment hedge. 11221-2 f 2 ii which states that the identification must be made substantially contemporaneously. Clear identification as a hedge before the close of the day on which the taxpayer acquired originated or entered into the transaction is required Regs.

IFRS 9 allows an alternative of designating full or the intrinsic value of an option as a hedging instrument IFRS 9624 a. In hedging activities in both financial and non-financial services entities. Hedge accounting can be applied to transactions between entities in the same group only in the individual or separate financial statements of those entities and not in the consolidated.

A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized asset or liability or a forecasted intercompany transaction. Assuming your cash flow hedge meets all hedge accounting criteria youll need to make the following steps. When treating the items individually such as a security and its associated hedge fund.

American Arborvitae Thuja occidentalis Smaragd This arborvitae cultivar is a popular evergreen conifer for dense privacy hedging. 2 the availability of natural hedges that can be highly effective. This rule is relaxed by Regs.

Disclosures Hedges Financial Position Annual Reporting

Derivatives And Hedging Gaap Dynamics

Ifrs 9 Basis Adjustment Best Short Read Annual Reporting

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Accounting For Fair Value Of Hedges Examples Journal Entries

0 comments

Post a Comment